DiPocket PSD2 API

This API provides possibility to fetch account information, funds confirmation and initiate payments on behalf of end users.

Base URLs:

https://openbanking.dipocket.org (Production environment)

https://openbanking.dipocket.site (Sandbox environment)

Introduction

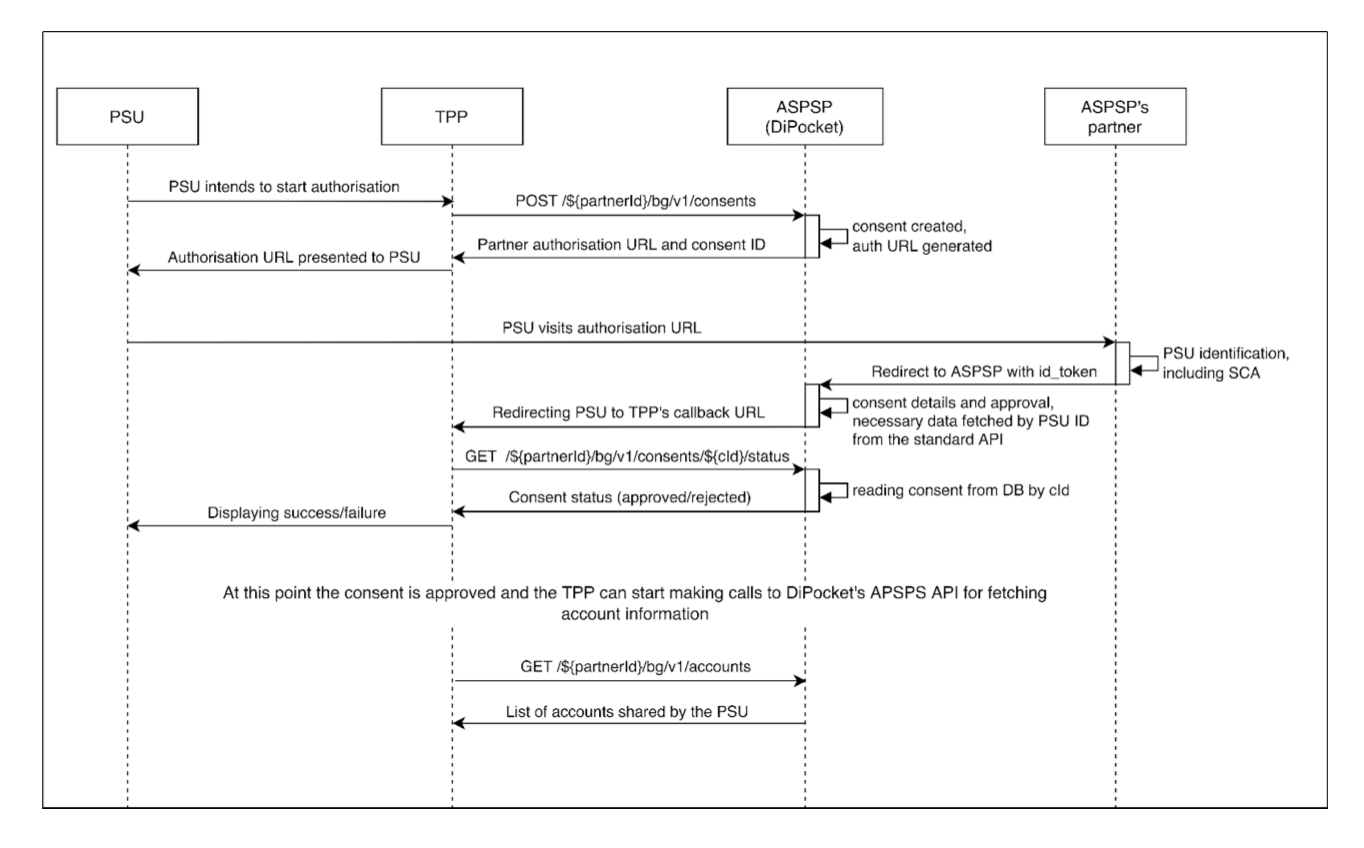

AIS flow

The following diagram shows the account information flow.

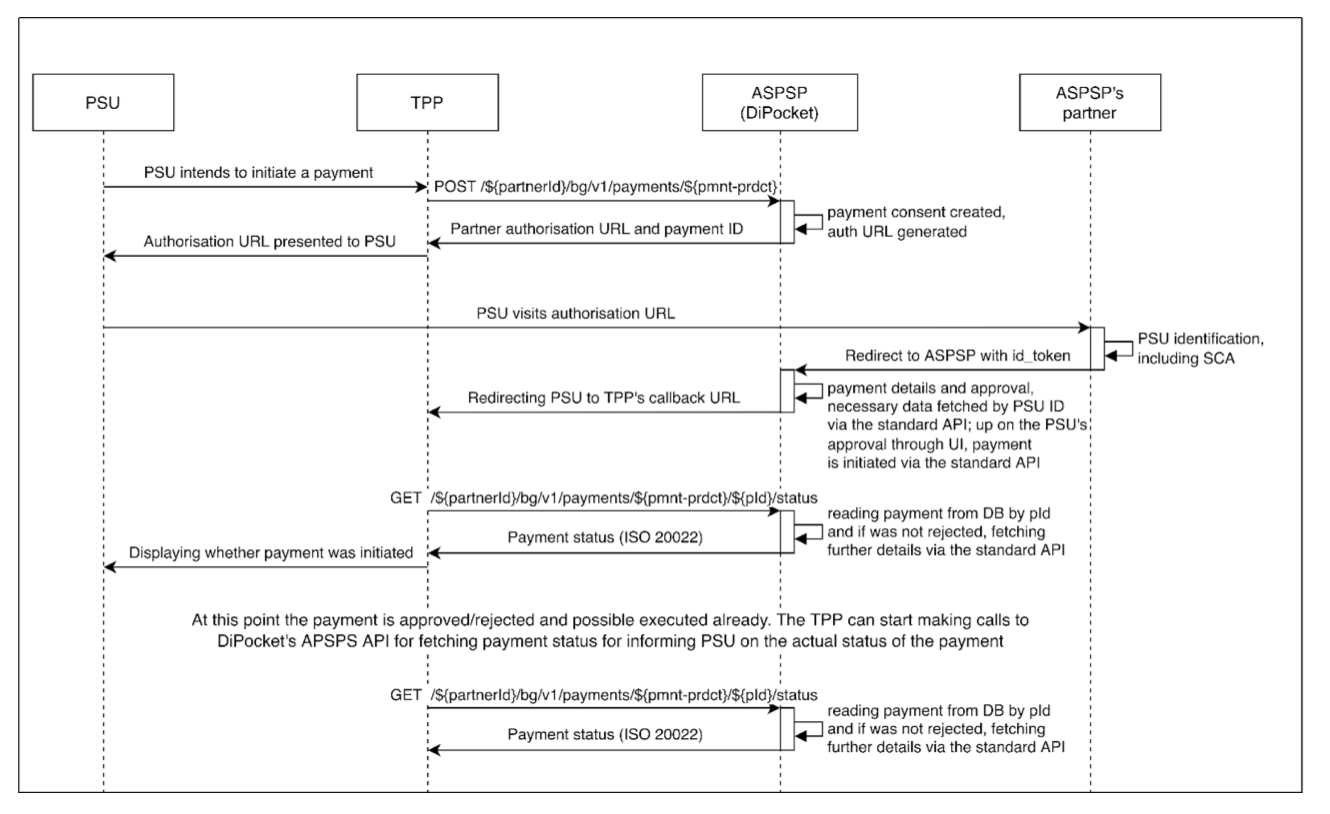

PIS flow

There are domestic, sepa and cross border payments available in aspsp-api. The following diagram shows the payment initiation flow.

There are mandatory fields for each of payment products:

| Field | type | domestic-credit-transfers | sepa-credit-transfers | cross-border-credit-transfers |

|---|---|---|---|---|

| debtorAccount | AccountReference | not required | not required | not required |

| instructedAmount | Amount | mandatory, inatructedAmount.currency can be only HUF or PLN | mandatory | mandatory |

| creditorName | String | mandatory | mandatory | mandatory |

| creditorAccount | AccountReference | mandatory | mandatory | mandatory |

| creditorType | INDIVIDUAL, COMPANY | mandatory | mandatory | mandatory |

| creditorAgent | String | not required | mandatory | mandatory |

| creditorAddress | Address | not required | mandatory only creditorAddress.country field | mandatory |

| remittanceInformationUnstructured | String | mandatory | mandatory | mandatory |

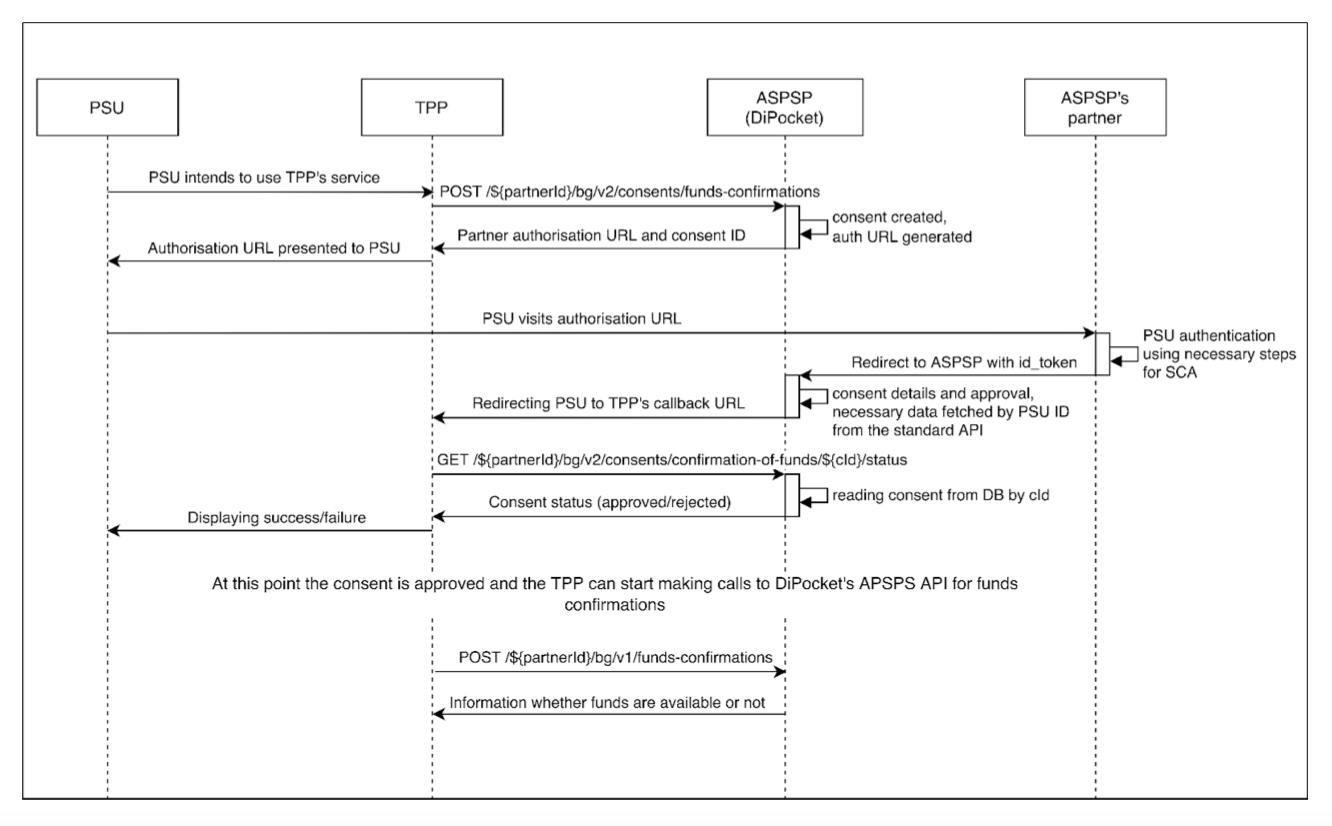

COF flow

The following diagram shows confirmation of funds flow.

Onboarding

In order to access the PSD2 APIs you will need a valid QWAC certificate.

Sandbox

There is no need to do onboarding, use DiPocket certificate to access sandbox. Download sandbox certificate here.

Production

Before you can use aspsp-api, we should onboard your application. Please send your production certificate to the following e-mail: [email protected]. After your application will be onboarded, we will inform you by the confirmation e-mail. If you have problems accessing sandbox or production, please contact us at: [email protected].

Confirmation of Funds

Confirmation of Funds Consent Request

Code samples

POST https://openbanking.dipocket.org/{brandId}/bg/v2/consents/confirmation-of-funds HTTP/1.1

Host: localhost:8080

Content-Type: application/json

Accept: */*

TPP-Redirect-URI: https://my-awesome-ui/ok

TPP-Nok-Redirect-URI: https://my-awesome-ui/error

POST /{brandId}/bg/v2/consents/confirmation-of-funds

Creates a confirmation of funds consent resource at the ASPSP regarding confirmation of funds access to an account specified in this request.

Body parameter

{

"account": {

"iban": "FI4950009420028730"

}

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| TPP-Redirect-URI | header | string | true | URI of the TPP, where the flow shall be redirected to after consent was successfully confirmed by the user. |

| TPP-Nok-Redirect-URI | header | string | false | If this URI is contained, the TPP is asking to redirect the transaction flow to this address instead of TPP-Redirect-URI in case if something went wrong or consent was cancelled. |

| body | body | CofConsentRequest | true | none |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | ConsentResponse |

Confirmation of Funds Request

Code samples

POST https://openbanking.dipocket.org/{brandId}/bg/v1/funds-confirmations HTTP/1.1

Host: localhost:8080

Content-Type: application/json

Accept: */*

Consent-ID: c67a3de6-5176-4c7d-a64d-e6ac4f31e848

POST /{brandId}/bg/v1/funds-confirmations

Creates a confirmation of funds request at the ASPSP.

Body parameter

{

"account": {

"iban": "FI4950009420028730"

},

"instructedAmount": {

"currency": "EUR",

"amount": "5877.78"

}

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| Consent-ID | header | string | true | The consent identification assigned to the created resource. |

| body | body | ConfirmationOfFundsRequest | true | none |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | ConfirmationOfFundsResponse |

Get Consent Request

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v2/consents/confirmation-of-funds/{consentId} HTTP/1.1

Host: localhost:8080

Accept: */*

GET /{brandId}/bg/v2/consents/confirmation-of-funds/{consentId}

Returns the content of an account information consent object.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| consentId | path | string | true | The consent identification assigned to the created resource. |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | CofConsentDetails |

Revoke a Confirmation of Funds Consent

Code samples

DELETE https://openbanking.dipocket.org/{brandId}/bg/v2/consents/confirmation-of-funds/{consentId} HTTP/1.1

Host: localhost:8080

DELETE /{brandId}/bg/v2/consents/confirmation-of-funds/{consentId}

The TPP can revoke an account information consent object if needed with the following call.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| consentId | path | string | true | Contains the resource-ID of the consent to be deleted. |

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | None |

Get Status Request

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v2/consents/confirmation-of-funds/{consentId}/status HTTP/1.1

Host: localhost:8080

Accept: */*

GET /{brandId}/bg/v2/consents/confirmation-of-funds/{consentId}/status

Can check the status of an account information consent resource.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| consentId | path | string | true | The consent identification assigned to the created resource. |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | ConsentStatusDto |

Payment initiation

Payment Initiation Request

Code samples

POST https://openbanking.dipocket.org/{brandId}/bg/v1/payments/{paymentProduct} HTTP/1.1

Host: localhost:8080

Content-Type: application/json

Accept: */*

TPP-Redirect-URI: https://my-awesome-ui/ok

TPP-Nok-Redirect-URI: https://my-awesome-ui/error

POST /{brandId}/bg/v1/payments/{paymentProduct}

Creates a payment initiation request at the ASPSP.

Body parameter

{

"debtorAccount": {

"iban": "FI4950009420028730"

},

"instructedAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"creditorName": "Merchant123",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"creditorType": "INDIVIDUAL",

"creditorAgent": "SBANFIHH",

"creditorAddress": {

"streetName": "Sörnäistenlaituri",

"buildingNumber": "23",

"townName": "Helsinki",

"postCode": "00530",

"country": "FI"

},

"remittanceInformationUnstructured": "For the friend"

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| paymentProduct | path | string | true | The possible values are 'domestic-credit-transfers', 'sepa-credit-transfers' or 'cross-border-credit-transfer'. |

| TPP-Redirect-URI | header | string | true | URI of the TPP, where the flow shall be redirected to after consent was successfully confirmed by the user. |

| TPP-Nok-Redirect-URI | header | string | false | If this URI is contained, the TPP is asking to redirect the transaction flow to this address instead of TPP-Redirect-URI in case if something went wrong or consent was cancelled. |

| body | body | PaymentDetails | true | none |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | PaymentsInitiationResponse |

Get Payment Request

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/payments/{paymentProduct}/{paymentId} HTTP/1.1

Host: localhost:8080

Accept: */*

GET /{brandId}/bg/v1/payments/{paymentProduct}/{paymentId}

Returns the content of a payment object.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| paymentProduct | path | string | true | The possible values are 'domestic-credit-transfers', 'sepa-credit-transfers' or 'cross-border-credit-transfer'. |

| paymentId | path | string | true | Resource Identification of the related payment. |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | PaymentRequest |

Get Transaction Status Request

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/payments/{paymentProduct}/{paymentId}/status HTTP/1.1

Host: localhost:8080

Accept: */*

GET /{brandId}/bg/v1/payments/{paymentProduct}/{paymentId}/status

Can check the status of a payment initiation.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| paymentProduct | path | string | true | The possible values are 'domestic-credit-transfers', 'sepa-credit-transfers' or 'cross-border-credit-transfer'. |

| paymentId | path | string | true | Resource Identification of the related payment. |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | TransactionStatusDto |

Account information

Consent Request

Code samples

POST https://openbanking.dipocket.org/{brandId}/bg/v1/consents HTTP/1.1

Host: localhost:8080

Content-Type: application/json

Accept: */*

TPP-Redirect-URI: https://my-awesome-ui/ok

TPP-Nok-Redirect-URI: https://my-awesome-ui/error

POST /{brandId}/bg/v1/consents

Creates an account information consent resource at the ASPSP regarding access to accounts specified in this request or without dedicated account.

Body parameter

{

"access": {

"accounts": [

{

"iban": "FI4950009420028730"

}

],

"balances": [

{

"iban": "FI4950009420028730"

}

],

"transactions": [

{

"iban": "FI4950009420028730"

}

]

},

"recurringIndicator": true,

"validUntil": "2023-10-10",

"frequencyPerDay": 0

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| TPP-Redirect-URI | header | string | true | URI of the TPP, where the flow shall be redirected to after consent was successfully confirmed by the user. |

| TPP-Nok-Redirect-URI | header | string | false | If this URI is contained, the TPP is asking to redirect the transaction flow to this address instead of TPP-Redirect-URI in case if something went wrong or consent was cancelled. |

| body | body | ConsentRequest | true | none |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | ConsentResponse |

Get Consent Request

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/consents/{consentId} HTTP/1.1

Host: localhost:8080

Accept: */*

GET /{brandId}/bg/v1/consents/{consentId}

Returns the content of an account information consent object.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| consentId | path | string | true | Identification of the consent resource as it is used in the API structure. |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | ConsentDetailsDto |

Delete an Account Information Consent Object

Code samples

DELETE https://openbanking.dipocket.org/{brandId}/bg/v1/consents/{consentId} HTTP/1.1

Host: localhost:8080

DELETE /{brandId}/bg/v1/consents/{consentId}

The TPP can delete an account information consent object if needed with the following call.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| consentId | path | string | true | Contains the resource-ID of the consent to be deleted. |

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | None |

Get Consent Status Request

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/consents/{consentId}/status HTTP/1.1

Host: localhost:8080

Accept: */*

GET /{brandId}/bg/v1/consents/{consentId}/status

Can check the status of an account information consent resource.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| consentId | path | string | true | Identification of the consent resource as it is used in the API structure. |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | ConsentStatusDto |

Read Account List

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/accounts HTTP/1.1

Host: localhost:8080

Accept: */*

Consent-ID: 41f1884e-2002-40ed-b43b-ab9e5e8a19e6

GET /{brandId}/bg/v1/accounts

Reads a list of bank accounts, with balances where required.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| Consent-ID | header | string | true | Identification of the corresponding consent as granted by the PSU |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | AccountsListDto |

Read Account Details

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/accounts/{accountId} HTTP/1.1

Host: localhost:8080

Accept: */*

Consent-ID: 41f1884e-2002-40ed-b43b-ab9e5e8a19e6

GET /{brandId}/bg/v1/accounts/{accountId}

Reads details about an account, with balances where required.

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| accountId | path | string | true | This identification is denoting the addressed account. The account-id is retrieved by using a "Read Account List" call. |

| Consent-ID | header | string | true | Identification of the corresponding consent as granted by the PSU |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | AccountDetailsResponse |

Read Transaction List

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/accounts/{accountId}/transactions?dateFrom=string&dateTo=string HTTP/1.1

Host: localhost:8080

Accept: */*

Consent-ID: 41f1884e-2002-40ed-b43b-ab9e5e8a19e6

GET /{brandId}/bg/v1/accounts/{accountId}/transactions

This operation is used to fetch available account transactions by provided account id. This can be either booked or pending transactions

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| accountId | path | string | true | This identification is denoting the addressed account. The account-id is retrieved by using a "Read Account List" call. |

| dateFrom | query | string | true | Starting date (inclusive the date dateFrom) |

| dateTo | query | string | true | End date (inclusive the date dateTo) |

| Consent-ID | header | string | true | Identification of the corresponding consent as granted by the PSU |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | TransactionsListDto |

Read Transaction Details

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/accounts/{accountId}/transactions/{transactionId} HTTP/1.1

Host: localhost:8080

Accept: */*

Consent-ID: 41f1884e-2002-40ed-b43b-ab9e5e8a19e6

GET /{brandId}/bg/v1/accounts/{accountId}/transactions/{transactionId}

Reads transaction details from a given transaction addressed by "transactionId" on a given account addressed by "account-id".

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| accountId | path | string | true | This identification is denoting the addressed account. The account-id is retrieved by using a "Read Account List" call. |

| transactionId | path | string | true | This identification is given by the attribute transactionId of the corresponding entry of a transaction list. |

| Consent-ID | header | string | true | Identification of the corresponding consent as granted by the PSU |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | TransactionsDetailsResponse |

Read Balance

Code samples

GET https://openbanking.dipocket.org/{brandId}/bg/v1/accounts/{accountId}/balances HTTP/1.1

Host: localhost:8080

Accept: */*

Consent-ID: 41f1884e-2002-40ed-b43b-ab9e5e8a19e6

GET /{brandId}/bg/v1/accounts/{accountId}/balances

Reads account data from a given account addressed by "account-id".

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| brandId | path | string | true | Id of brand (list of DiPocket brands is available by GET /brands) |

| accountId | path | string | true | This identification is denoting the addressed account. The account-id is retrieved by using a "Read Account List" call. |

| Consent-ID | header | string | true | Identification of the corresponding consent as granted by the PSU |

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | AccountBalancesDto |

Brands

Get brands

Code samples

GET https://openbanking.dipocket.org/brands HTTP/1.1

Host: localhost:8080

Accept: */*

GET /brands

Returns the list of DiPocket brands.

Example responses

200 Response

Responses

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | OK | BrandsResponse |

Schemas

AccountReference

{

"iban": "FI4950009420028730"

}

PSU’s account number.

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| iban | string | true | The International Bank Account Number. |

CofConsentRequest

{

"account": {

"iban": "FI4950009420028730"

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| account | AccountReference | false | PSU’s account number. |

ConsentResponse

{

"consentId": "c67a3de6-5176-4c7d-a64d-e6ac4f31e848",

"consentStatus": "received",

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| consentId | string | false | The consent identification assigned to the created resource. |

| consentStatus | string | false | Authentication status of the consent. |

| _links | object | false | none |

| » additionalProperties | Link | false | none |

Enumerated Values

| Property | Value |

|---|---|

| consentStatus | received |

| consentStatus | rejected |

| consentStatus | partiallyAuthorised |

| consentStatus | valid |

| consentStatus | revokedByPsu |

| consentStatus | expired |

| consentStatus | terminatedByTpp |

Link

{

"href": "string"

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| href | string | true | Link to resource. |

Address

{

"streetName": "Sörnäistenlaituri",

"buildingNumber": "23",

"townName": "Helsinki",

"postCode": "00530",

"country": "FI"

}

Creditor address. Not required for domestic payments

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| streetName | string | false | Street name. Required field for SWIFT payments. |

| buildingNumber | string | false | Building number. Required field for SWIFT payments. |

| townName | string | false | Town name. Required field for SWIFT payments. |

| postCode | string | false | Post code. Required field for SWIFT payments. |

| country | string | false | Two-letter country codes defined in ISO 3166-1. Required field for SWIFT and SEPA payments. |

Amount

{

"currency": "EUR",

"amount": "5877.78"

}

Amount with currency

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| currency | string | true | ISO 4217 Alpha 3 currency code. |

| amount | string | true | The amount given with fractional digits, where fractions must be compliant to the currency definition. Negative amounts are signed by minus. The decimal separator is a dot. |

PaymentDetails

{

"debtorAccount": {

"iban": "FI4950009420028730"

},

"instructedAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"creditorName": "Merchant123",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"creditorType": "INDIVIDUAL",

"creditorAgent": "SBANFIHH",

"creditorAddress": {

"streetName": "Sörnäistenlaituri",

"buildingNumber": "23",

"townName": "Helsinki",

"postCode": "00530",

"country": "FI"

},

"remittanceInformationUnstructured": "For the friend"

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| debtorAccount | AccountReference | false | PSU’s account number. |

| instructedAmount | Amount | true | Amount with currency |

| creditorName | string | true | Name of the creditor. |

| creditorAccount | AccountReference | true | PSU’s account number. |

| creditorType | string | true | Creditor type. Possible values: INDIVIDUAL or COMPANY |

| creditorAgent | string | false | Unique and unambiguous identification of a financial institution, as assigned under an internationally recognised or proprietary identification scheme. |

| creditorAddress | Address | false | Creditor address. Not required for domestic payments |

| remittanceInformationUnstructured | string | true | Unstructured message to be assigned to a payment instruction. Number of supported lines and structure of each line depend on the payment type and the chosen ASPSP and is provided in the payment type information. In case values of both remittanceInformation and referenceNumber field are provided, the referenceNumber will be used. |

Enumerated Values

| Property | Value |

|---|---|

| creditorType | INDIVIDUAL |

| creditorType | COMPANY |

PaymentsInitiationResponse

{

"transactionStatus": "ACCC",

"paymentId": "737192d0-9f3b-49b4-85bb-f612ce8726b7",

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| transactionStatus | string | false | The transaction status is filled with codes of the ISO 20022 data table. |

| paymentId | string | false | Resource Identification of the related payment. |

| _links | object | false | none |

| » additionalProperties | Link | false | none |

Enumerated Values

| Property | Value |

|---|---|

| transactionStatus | ACCC |

| transactionStatus | ACCP |

| transactionStatus | ACSC |

| transactionStatus | ACSP |

| transactionStatus | ACTC |

| transactionStatus | ACWC |

| transactionStatus | ACWP |

| transactionStatus | RCVD |

| transactionStatus | PDNG |

| transactionStatus | RJCT |

| transactionStatus | CANC |

| transactionStatus | ACFC |

| transactionStatus | PATC |

| transactionStatus | PART |

ConfirmationOfFundsRequest

{

"account": {

"iban": "FI4950009420028730"

},

"instructedAmount": {

"currency": "EUR",

"amount": "5877.78"

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| account | AccountReference | false | PSU’s account number. |

| instructedAmount | Amount | false | Amount with currency |

ConfirmationOfFundsResponse

{

"fundsAvailable": true

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| fundsAvailable | boolean | false | Equals true if sufficient funds are available at the time of the request, false otherwise. |

AccountAccess

{

"accounts": [

{

"iban": "FI4950009420028730"

}

],

"balances": [

{

"iban": "FI4950009420028730"

}

],

"transactions": [

{

"iban": "FI4950009420028730"

}

]

}

Requested access services.

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| accounts | [AccountReference] | false | Is asking for detailed account information. |

| balances | [AccountReference] | false | Is asking for balances of the addressed accounts. |

| transactions | [AccountReference] | false | Is asking for transactions of the addressed accounts. |

ConsentRequest

{

"access": {

"accounts": [

{

"iban": "FI4950009420028730"

}

],

"balances": [

{

"iban": "FI4950009420028730"

}

],

"transactions": [

{

"iban": "FI4950009420028730"

}

]

},

"recurringIndicator": true,

"validUntil": "2023-10-10",

"frequencyPerDay": 0

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| access | AccountAccess | true | Requested access services. |

| recurringIndicator | boolean | true | true, if the consent is for recurring access to the account data false, if the consent is for one access to the account data |

| validUntil | string(date) | true | This parameter is defining a valid until date for the requested consent. The content is the local ASPSP date in ISODate Format. |

| frequencyPerDay | integer(int32) | false | Not supported. This field indicates the requested maximum frequency for an access without PSU involvement per day. |

CofConsentDetails

{

"account": {

"iban": "FI4950009420028730"

},

"consentStatus": "received"

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| account | AccountReference | false | PSU’s account number. |

| consentStatus | string | false | Authentication status of the consent. |

Enumerated Values

| Property | Value |

|---|---|

| consentStatus | received |

| consentStatus | rejected |

| consentStatus | partiallyAuthorised |

| consentStatus | valid |

| consentStatus | revokedByPsu |

| consentStatus | expired |

| consentStatus | terminatedByTpp |

ConsentStatusDto

{

"consentStatus": "received"

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| consentStatus | string | false | none |

Enumerated Values

| Property | Value |

|---|---|

| consentStatus | received |

| consentStatus | rejected |

| consentStatus | partiallyAuthorised |

| consentStatus | valid |

| consentStatus | revokedByPsu |

| consentStatus | expired |

| consentStatus | terminatedByTpp |

PaymentRequest

{

"transactionStatus": "ACCC",

"paymentId": "737192d0-9f3b-49b4-85bb-f612ce8726b7",

"paymentDetails": {

"debtorAccount": {

"iban": "FI4950009420028730"

},

"instructedAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"creditorName": "Merchant123",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"creditorType": "INDIVIDUAL",

"creditorAgent": "SBANFIHH",

"creditorAddress": {

"streetName": "Sörnäistenlaituri",

"buildingNumber": "23",

"townName": "Helsinki",

"postCode": "00530",

"country": "FI"

},

"remittanceInformationUnstructured": "For the friend"

},

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| transactionStatus | string | false | The transaction status is filled with codes of the ISO 20022 data table. |

| paymentId | string | false | Resource Identification of the related payment. |

| paymentDetails | PaymentDetails | false | none |

| _links | object | false | none |

| » additionalProperties | Link | false | none |

Enumerated Values

| Property | Value |

|---|---|

| transactionStatus | ACCC |

| transactionStatus | ACCP |

| transactionStatus | ACSC |

| transactionStatus | ACSP |

| transactionStatus | ACTC |

| transactionStatus | ACWC |

| transactionStatus | ACWP |

| transactionStatus | RCVD |

| transactionStatus | PDNG |

| transactionStatus | RJCT |

| transactionStatus | CANC |

| transactionStatus | ACFC |

| transactionStatus | PATC |

| transactionStatus | PART |

TransactionStatusDto

{

"transactionStatus": "ACCC"

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| transactionStatus | string | false | The transaction status is filled with codes of the ISO 20022 data table. |

Enumerated Values

| Property | Value |

|---|---|

| transactionStatus | ACCC |

| transactionStatus | ACCP |

| transactionStatus | ACSC |

| transactionStatus | ACSP |

| transactionStatus | ACTC |

| transactionStatus | ACWC |

| transactionStatus | ACWP |

| transactionStatus | RCVD |

| transactionStatus | PDNG |

| transactionStatus | RJCT |

| transactionStatus | CANC |

| transactionStatus | ACFC |

| transactionStatus | PATC |

| transactionStatus | PART |

ConsentDetailsDto

{

"access": {

"accounts": [

{

"iban": "FI4950009420028730"

}

],

"balances": [

{

"iban": "FI4950009420028730"

}

],

"transactions": [

{

"iban": "FI4950009420028730"

}

]

},

"recurringIndicator": true,

"validUntil": "2019-08-24",

"consentStatus": "received",

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| access | AccountAccess | false | Requested access services. |

| recurringIndicator | boolean | false | none |

| validUntil | string(date) | false | none |

| consentStatus | string | false | none |

| _links | object | false | none |

| » additionalProperties | Link | false | none |

Enumerated Values

| Property | Value |

|---|---|

| consentStatus | received |

| consentStatus | rejected |

| consentStatus | partiallyAuthorised |

| consentStatus | valid |

| consentStatus | revokedByPsu |

| consentStatus | expired |

| consentStatus | terminatedByTpp |

AccountDetails

{

"resourceId": "33154",

"iban": "string",

"currency": "EUR",

"ownerName": "Krzysztofa Dell",

"product": "string",

"cashAccountType": "CACC",

"name": "string",

"status": "enabled",

"details": "string",

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| resourceId | string | true | This is the data element to be used in the path when retrieving data from a dedicated account. |

| iban | string | true | This data element can be used in the body of the Consent Request Message for retrieving account access consent from this payment account. |

| currency | string | true | Account currency |

| ownerName | string | false | Name of the legal account owner. |

| product | string | false | Product Name of the Bank for this account, proprietary definition. |

| cashAccountType | string | false | ExternalCashAccountType1Code from ISO 20022 |

| name | string | false | Name of the account, as assigned by the ASPSP, in agreement with the account owner in order to provide an additional means of identification of the account. |

| status | string | true | Account status |

| details | string | false | Characteristics of the account |

| _links | object | true | Links to balances and transactions for the account. |

| » additionalProperties | Link | false | none |

Enumerated Values

| Property | Value |

|---|---|

| cashAccountType | CACC |

| cashAccountType | CASH |

| cashAccountType | CHAR |

| cashAccountType | CISH |

| cashAccountType | COMM |

| cashAccountType | CPAC |

| cashAccountType | LLSV |

| cashAccountType | LOAN |

| cashAccountType | MGLD |

| cashAccountType | MOMA |

| cashAccountType | NREX |

| cashAccountType | ODFT |

| cashAccountType | ONDP |

| cashAccountType | OTHR |

| cashAccountType | SACC |

| cashAccountType | SLRY |

| cashAccountType | SVGS |

| cashAccountType | TAXE |

| cashAccountType | TRAN |

| cashAccountType | TRAS |

| status | enabled |

| status | deleted |

| status | blocked |

AccountsListDto

{

"accounts": [

{

"resourceId": "33154",

"iban": "string",

"currency": "EUR",

"ownerName": "Krzysztofa Dell",

"product": "string",

"cashAccountType": "CACC",

"name": "string",

"status": "enabled",

"details": "string",

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

]

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| accounts | [AccountDetails] | false | none |

AccountDetailsResponse

{

"account": {

"resourceId": "33154",

"iban": "string",

"currency": "EUR",

"ownerName": "Krzysztofa Dell",

"product": "string",

"cashAccountType": "CACC",

"name": "string",

"status": "enabled",

"details": "string",

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| account | AccountDetails | false | none |

AccountReport

{

"booked": [

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

],

"pending": [

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

],

"information": [

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

],

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| booked | [Transaction] | false | List of transactions in status "booked" |

| pending | [Transaction] | false | List of transactions in status "pending" |

| information | [Transaction] | false | List of transactions in status "information" |

| _links | object | false | Contains a link to account details resource. |

| » additionalProperties | Link | false | none |

Transaction

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

List of transactions in status "information"

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| transactionId | string | false | A unique and immutable identifier used to identify the transaction resource. |

| entryReference | string | false | none |

| creditorName | string | false | Name of the creditor if a "Debited" transaction |

| creditorAccount | AccountReference | false | PSU’s account number. |

| debtorName | string | false | Name of the debtor if a "Credited" transaction |

| debtorAccount | AccountReference | false | PSU’s account number. |

| mandateId | string | false | Identification of Mandates, e.g. a SEPA Mandate ID |

| transactionAmount | Amount | true | Amount with currency |

| bookingDate | string(date-time) | false | The Date when an entry is posted to an account on the ASPSPs books. |

| valueDate | string(date-time) | false | Date and time at which assets become available to the account owner in case of a credit entry, or cease to be available to the account owner in case of a debit entry. |

| remittanceInformationUnstructured | string | true | Unstructured message to be assigned to a payment instruction. Number of supported lines and structure of each line depend on the payment type and the chosen ASPSP and is provided in the payment type information. In case values of both remittanceInformation and referenceNumber field are provided, the referenceNumber will be used. |

| bankTransactionCode | string | false | Bank transaction code as used by the ASPSP andusingthesubelementsof this structured code defined by ISO20022. |

| proprietaryBankTransactionCode | string | false | proprietary bank transaction code as used within a community or within an ASPSP e.g. for MT94x based transaction reports |

TransactionsListDto

{

"account": {

"iban": "FI4950009420028730"

},

"transactions": {

"booked": [

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

],

"pending": [

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

],

"information": [

{

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

],

"_links": {

"property1": {

"href": "string"

},

"property2": {

"href": "string"

}

}

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| account | AccountReference | false | PSU’s account number. |

| transactions | AccountReport | false | none |

TransactionsDetailsResponse

{

"transactionsDetails": {

"transactionId": "string",

"entryReference": "string",

"creditorName": "Rut Rameshvara",

"creditorAccount": {

"iban": "FI4950009420028730"

},

"debtorName": "Bityah Amita",

"debtorAccount": {

"iban": "FI4950009420028730"

},

"mandateId": "string",

"transactionAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"bookingDate": "2019-08-24T14:15:22Z",

"valueDate": "2019-08-24T14:15:22Z",

"remittanceInformationUnstructured": "For the friend",

"bankTransactionCode": "string",

"proprietaryBankTransactionCode": "string"

}

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| transactionsDetails | Transaction | false | List of transactions in status "information" |

AccountBalancesDto

{

"account": {

"iban": "FI4950009420028730"

},

"balances": [

{

"balanceAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"balanceType": "expected",

"lastChangeDateTime": "2019-08-24T14:15:22Z",

"referenceDate": "2019-08-24T14:15:22Z"

}

]

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| account | AccountReference | false | PSU’s account number. |

| balances | [Balance] | false | none |

Balance

{

"balanceAmount": {

"currency": "EUR",

"amount": "5877.78"

},

"balanceType": "expected",

"lastChangeDateTime": "2019-08-24T14:15:22Z",

"referenceDate": "2019-08-24T14:15:22Z"

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| balanceAmount | Amount | true | Amount with currency |

| balanceType | string | true | Type of the balance. |

| lastChangeDateTime | string(date-time) | false | This data element might be used to indicate e.g. with the expected or booked balance that no action is known on the account, which is not yet booked. |

| referenceDate | string(date-time) | false | Indicates the date of the balance |

Enumerated Values

| Property | Value |

|---|---|

| balanceType | expected |

| balanceType | closingBooked |

| balanceType | interimAvailable |

| balanceType | interimBooked |

BrandInfo

{

"brandName": "EnableBanking",

"brandId": "654321",

"authorizationEndpoint": "https://psd2-auth-test.dipocket.org/authorize"

}

List of DiPocket brands with id's and authorisation endpoints

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| brandName | string | false | Name of DiPocket brand |

| brandId | string | false | DiPocket brand id, which is needed to access PSD2 endpoints |

| authorizationEndpoint | string | false | Link to DiPocket brand's authorisation endpoint. Each brand use their own endpoint. |

BrandsResponse

{

"brands": [

{

"brandName": "EnableBanking",

"brandId": "654321",

"authorizationEndpoint": "https://psd2-auth-test.dipocket.org/authorize"

}

]

}

Properties

| Name | Type | Required | Description |

|---|---|---|---|

| brands | [BrandInfo] | false | List of DiPocket brands with id's and authorisation endpoints |